IPO

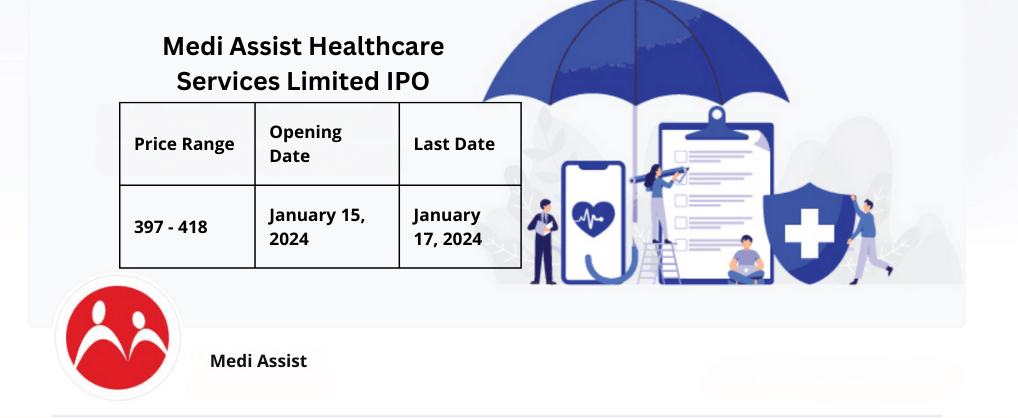

Medi Assist Healthcare Services Limited IPO: A Comprehensive Guide to GMP, Price Band, and More

The financial landscape is abuzz as Medi Assist Healthcare Services Limited opens its IPO today, promising a unique opportunity for investors to delve into the world of third-party administration services. In this SEO-friendly guide, we unravel the key details, financial insights, and the IPO schedule, ensuring you’re well-equipped to navigate this investment prospect.

What Does Medi Assist Healthcare Services Limited Do?

Medi Assist Healthcare Services Limited operates through its subsidiaries, including Medi Assist TPA, Medvantage TPA, and Raksha TPA, offering third-party administration services to insurance companies. These services encompass health insurance claim processing, policy administration, customer service, and network management. With a notable market share in retail and group health insurance markets, the company manages substantial health insurance premiums and collaborates with 35 insurance companies globally.

In addition to third-party administration, Medi Assist facilitates various healthcare and ancillary services, boasting a comprehensive provider network spanning 18,754 hospitals across India and 141 countries.

Medi Assist Healthcare Services Limited IPO Details: Issue Size and Financial Metrics

The IPO comprises an offer for sale of up to 28.02 lakh equity shares. Delving into the financials, as of March 31, 2023, the company reported total assets of ₹705.72 crores, total revenue of ₹518.96 crores, and a notable ₹53.94 crores in net cash and cash equivalents. Profit after taxes stood at ₹75.31 crores, showcasing the company’s financial stability.

Risk Factors to Consider:

- Outstanding legal proceedings against promoters.

- Revenue dependency on subsidiaries, Medi Assist TPA and Medvantage TPA.

- Previous show-cause notices from IRDAI to subsidiaries.

- Handling sensitive medical data, posing legal and reputational risks.

IPO Schedule: Mark Your Calendar

- Issue Period: January 15 to January 17, 2024

- Allotment Finalization: January 18, 2024

- Refunds Initiation: January 19, 2024

- Credit of Shares: January 19, 2024

- Listing Date: January 22, 2024

How to Apply and Check Allotment: To apply, use a supported UPI app, enter your bid on Kite, and accept the UPI mandate on your phone. The bid amount will be blocked upon acceptance. Check the allotment status on the Registrar and Transfer agent’s website post-IPO.

| Event | Date |

|---|---|

| IPO Issue Period | January 15 to January 17, 2024 |

| Deadline for UPI Mandate Acceptance | Until 5 PM on the issue closing day |

| Allotment Finalization | January 18, 2024 |

| Initiation of Refunds | January 19, 2024 |

| Credit of Shares | January 19, 2024 |

| Date of Listing | January 22, 2024 |

| Mandate End Date | February 01, 2024 |

| Anchor Investors Lock-In End Date (50% of the investment) | February 17, 2024 |

| Anchor Investors Lock-In End Date (Remaining investment) | April 17, 2024 |

-

Entertainment1 year ago

Entertainment1 year agoSangeetha Waliketiya: The Rising Star of Sri Lankan Modeling I Photo Gallery 2024

-

Entertainment1 year ago

Entertainment1 year agoAitana Lopez: Spain’s AI-Generated Influencer Earning ₹3 Lakh Monthly Sparks AI Impact Concerns

-

OTT1 year ago

OTT1 year ago‘Oppenheimer’ OTT Release Details, Cast, and Storyline Unveiled! Watch Now on Amazon Prime From November 22

-

OTT1 year ago

OTT1 year agoUnlocking Entertainment: Airtel and Jio Prepaid Plans Offering Free Netflix Subscriptions 2023

-

Finance1 year ago

Finance1 year agoIndia’s Economy Surges Beyond $4 Trillion GDP Mark, Poised to Become Fourth Global Economic Powerhouse

-

Entertainment1 year ago

Entertainment1 year agoSalaar: Netflix OTT Release Date Rumors, Box Office Triumph, and Star-Studded Cast {updated}

-

OTT1 year ago

OTT1 year ago“Siddharth’s Acclaimed Thriller ‘Chithha’ Set for Digital Premiere on Disney + Hotstar

-

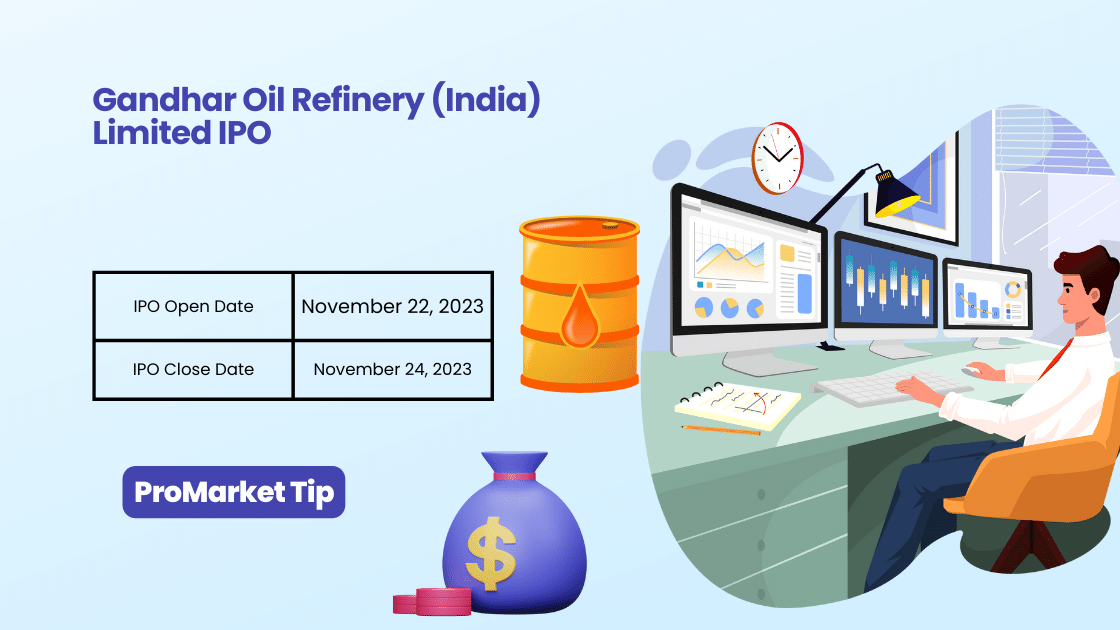

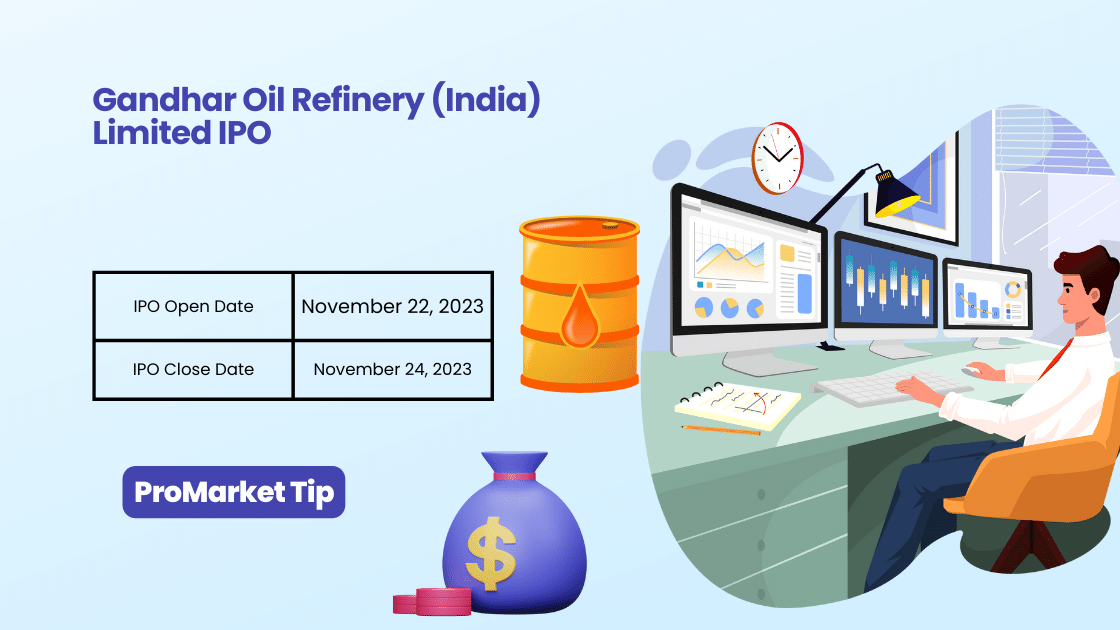

IPO1 year ago

IPO1 year agoExploring Gandhar Oil Refinery’s IPO Launch: Investor Interest, Market Sentiment, and Company Insights