Finance

Nifty’s Next Move Hangs in the Balance: Key Levels and Factors to Watch

As the Nifty 50 index navigates a narrow trading range, investors are closely monitoring key levels and market dynamics to gauge the direction of the next leg of the rally. Despite reaching a fresh all-time high and displaying resilience, certain indicators suggest caution is warranted.

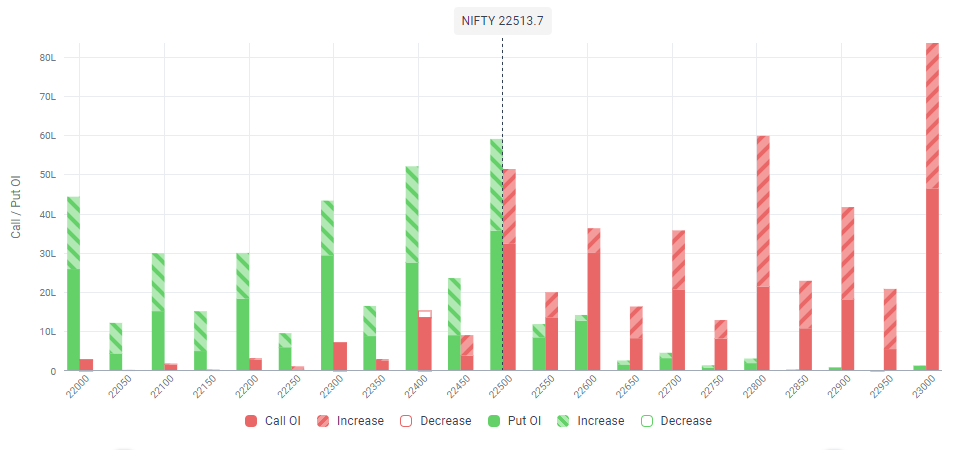

Nifty’s Recent Performance: Throughout the past week, the Nifty 50 index oscillated within a range of 22,300 to 22,600, with a notable resistance observed around the crucial 22,500 level. Despite closing at 22,514, marking a weekly gain of 187 points, the lack of significant momentum raises concerns.

India VIX and Market Volatility: The decline in India VIX, a measure of market volatility, has provided some relief to bullish sentiment. However, with impending elections and the onset of the Q4 earnings season, the possibility of volatility resurgence looms, potentially impacting market sentiment.

Foreign Portfolio Investors (FPIs) Activity: FPIs’ activity in Index futures remains subdued, with a prevailing trend of holding more short positions relative to longs. This cautious stance, observed since January 18, 2024, indicates a lack of robust participation, which could hinder momentum.

Weak Price Action Structure and Derivative Data: A discernible weakness in price action, coupled with bearish divergence in the relative strength index (RSI), suggests underlying concerns. Moreover, the current uptrend appears fueled by short covering rather than fresh long positions, posing challenges for sustained momentum.

Critical Juncture and Key Levels: The Nifty’s inability to convincingly breach the 22,500 level underscores the prevailing market dynamics. The intense battle between Call and Put writers at this strike highlights the significance of this level in determining the index’s future trajectory.

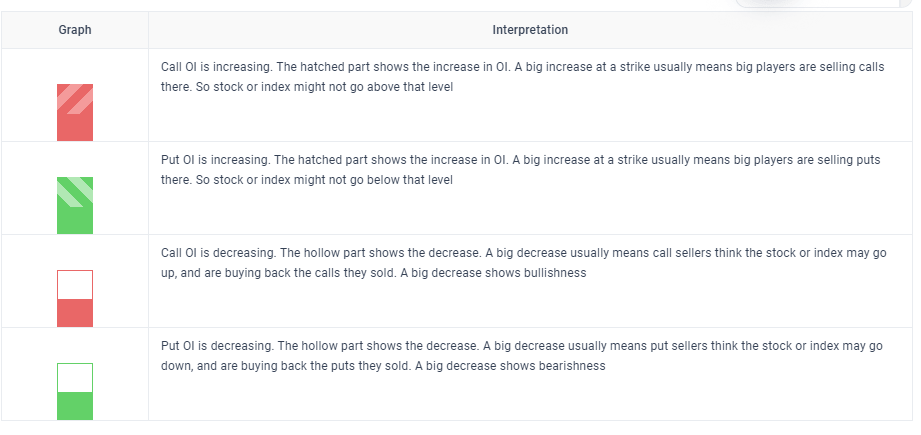

How to read the Open Interest Change Graph?

This chart shows the change in open interest by each strike. When Show OI toggle is turned on, it shows the change in OI along with the outstanding OI.

Caution Advised Amid Uncertainty: Given the weak price action structure and derivative data, exercising caution is prudent. A decisive close above 22,500 is imperative to signal the resumption of the upward trend. Until then, the market remains vulnerable to potential downside risks.

In conclusion, while the Nifty 50 index exhibits resilience, underlying factors warrant vigilance. By staying informed about critical levels and market dynamics, investors can navigate volatile market conditions effectively.

(Disclaimer: The content provided herein is for informational purposes only and should not be construed as financial advice.)

-

Entertainment1 year ago

Entertainment1 year agoSangeetha Waliketiya: The Rising Star of Sri Lankan Modeling I Photo Gallery 2024

-

Entertainment1 year ago

Entertainment1 year agoAitana Lopez: Spain’s AI-Generated Influencer Earning ₹3 Lakh Monthly Sparks AI Impact Concerns

-

OTT1 year ago

OTT1 year ago‘Oppenheimer’ OTT Release Details, Cast, and Storyline Unveiled! Watch Now on Amazon Prime From November 22

-

OTT1 year ago

OTT1 year agoUnlocking Entertainment: Airtel and Jio Prepaid Plans Offering Free Netflix Subscriptions 2023

-

Finance1 year ago

Finance1 year agoIndia’s Economy Surges Beyond $4 Trillion GDP Mark, Poised to Become Fourth Global Economic Powerhouse

-

Entertainment1 year ago

Entertainment1 year agoSalaar: Netflix OTT Release Date Rumors, Box Office Triumph, and Star-Studded Cast {updated}

-

OTT1 year ago

OTT1 year ago“Siddharth’s Acclaimed Thriller ‘Chithha’ Set for Digital Premiere on Disney + Hotstar

-

IPO1 year ago

IPO1 year agoExploring Gandhar Oil Refinery’s IPO Launch: Investor Interest, Market Sentiment, and Company Insights